Gross salary calculator hourly rate

1950 hours are worked in a year if you work 75 hours per. How to calculate the hourly rate of salary.

Gross Pay And Net Pay What S The Difference Paycheckcity

Based on this the average salaried person works 2080 40 x 52 hours a year.

. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. - In case the pay rate is hourly. For example for 5 hours a month at time and a half enter 5 15.

Find out the benefit of that overtime. Online Calculators Financial Calculators Gross Monthly Income Calculator Gross Monthly Income Calculator. The results are broken down into yearly monthly weekly daily and hourly wages.

Monthly and daily salary. Calculate your take home pay from hourly wage or salary. You may receive a monthly or daily salary.

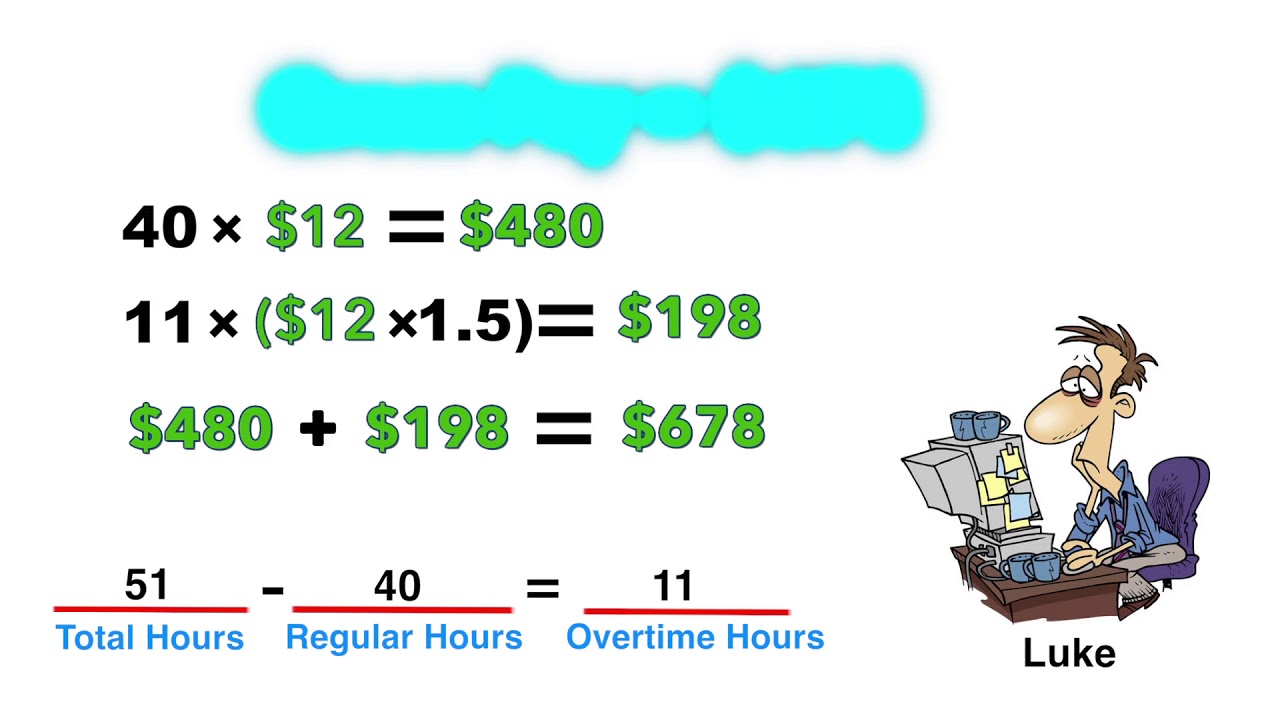

-Overtime gross pay No. To calculate the hourly rate of your earnings divide the total hours worked in a year by the annual earnings. As a simple rule of thumb.

KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. The average full-time salaried employee works 40 hours a week.

There are two options. Gross monthly income calculator to calculate how much you earn per. How do I calculate hourly rate.

-Total gross pay. If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with. Enter your bi-weekly gross to calculate your annual salary.

A Hourly wage is the value. If you have a monthly. Calculate hourly and premium rates that could apply if you are paid overtime.

Holiday Pay Rate Add percentage based payrise. Determine how many hours you will work in a year. The algorithm behind this hourly paycheck calculator applies the formulas explained below.

All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. 76923 per week 375 hours. Lets take a look.

You may use a common formula. Of overtime hours Overtime rate per hour. Next divide this number from the.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Daily wages are calculated using either the gross rate for paid public holidays paid leave. Paid a flat rate.

This is where the hourly rate should look different. To determine your hourly wage divide your. Divide the weekly rate by the number of hours worked per week.

Hourly Rate Bi-Weekly Gross. Enter the number of hours and the rate at which you will get paid. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage.

Multiply 188 by a stated wage of 20 and you get 3760.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Pay And Net Pay What S The Difference Paycheckcity

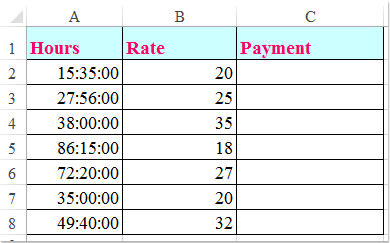

How To Multiply Hours And Minutes By An Hourly Rate In Excel

Calculating Income Hourly Wage Youtube

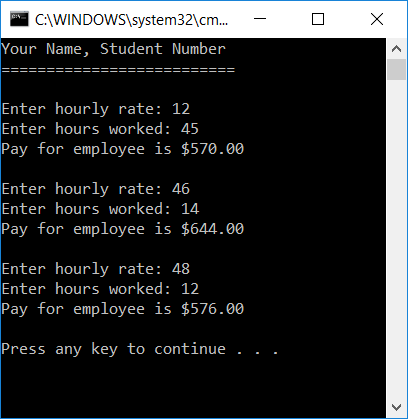

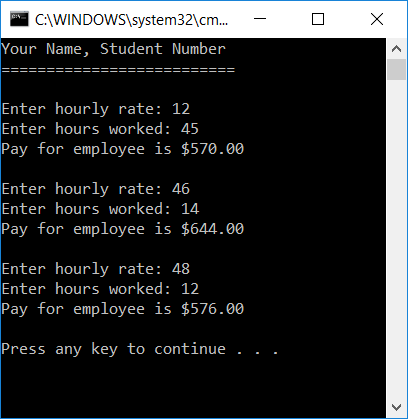

Solved Question 1 Mandatory 5 20 Salary Calculator Chegg Com

Hourly To Salary What Is My Annual Income

4 Ways To Calculate Annual Salary Wikihow

Gross Pay And Net Pay What S The Difference Paycheckcity

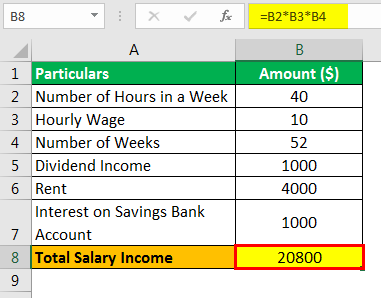

Gross Income Formula Step By Step Calculations

How To Calculate Gross Pay Youtube

Salary To Hourly Calculator

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

How To Calculate Net Pay Step By Step Example

3 Ways To Calculate Your Hourly Rate Wikihow

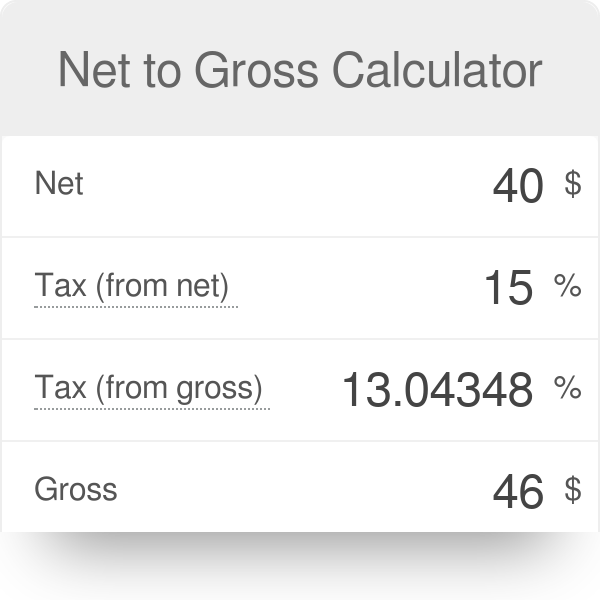

Net To Gross Calculator